On October 18th, 2024, the stock price of Manappuram Finance Ltd witnessed a sharp decline, raising concerns among investors. The company, known for its gold loan services, microfinance, and other financial offerings, experienced a drop in its stock value by nearly 33% from its all-time high achieved just a few months earlier in July 2024. This blog will provide an in-depth analysis of the reasons behind the crash, key financial metrics, and a perspective on whether this presents a potential buying opportunity.

What Happened?

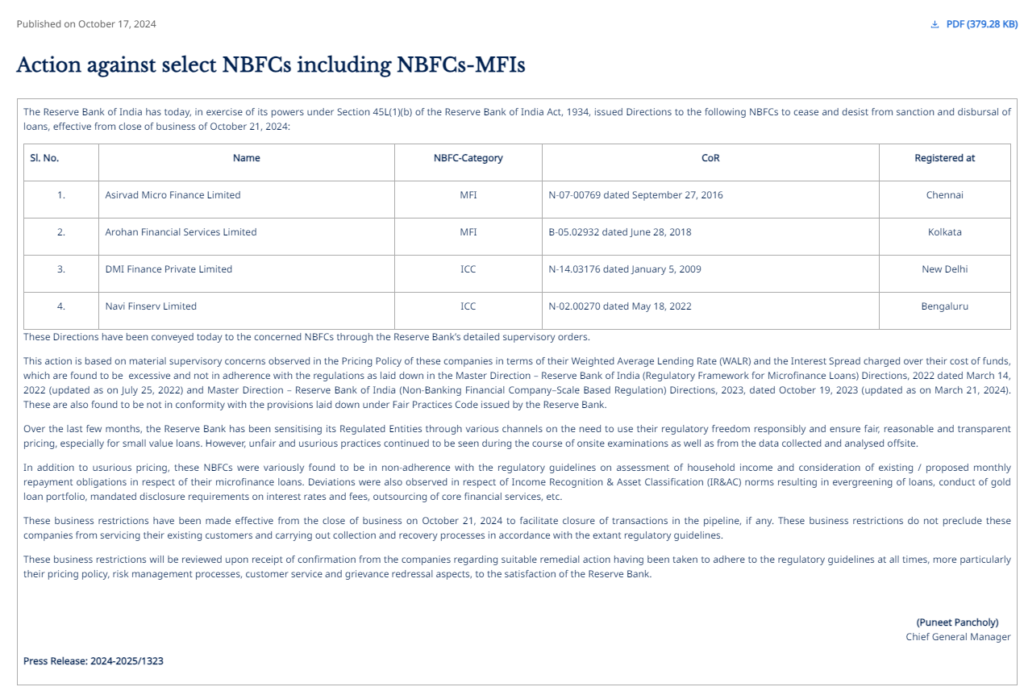

The recent dip in Manappuram’s stock price can be attributed to regulatory actions affecting its subsidiary, Asirvad Micro Finance. The Reserve Bank of India (RBI) instructed Asirvad to halt new loan disbursements due to non-compliance with certain regulations. Since Asirvad contributes significantly to the overall Asset Under Management (AUM) of Manappuram (approximately 27% as of Q3 FY23), this restriction raised red flags about Manappuram’s future earnings potential. The market reacted negatively, pushing the share price down amid concerns over the company’s short-term growth prospects.

Key Financials: A Quick Overview of Manappuram Finance

Manappuram Finance Ltd is a non-banking finance company (NBFC) with a significant presence in gold loans, contributing 58% to its total AUM as of Q3 FY23. Over the years, the company has expanded its services to include microfinance, home loans, and commercial vehicle financing. The company’s gold loan business is stable, while the rapid growth in microfinance and other segments has been a key driver of its diversification strategy.

Here are some important financial highlights of Manappuram Finance:

| Metric | Value | Good / Bad | Weightage (out of 10) | Remarks |

|---|---|---|---|---|

| Market Cap | ₹12,973 Cr | GOOD | 7 | Mid-cap company with solid market presence in the NBFC sector. |

| Current Price | ₹153 | NEUTRAL | 5 | Price near 52-week low, may present a value-buying opportunity if risks are resolved. |

| High / Low | ₹230 / ₹125 | NEUTRAL | 5 | Trading near its lower range; could be seen as undervalued but market concerns need consideration. |

| Stock P/E | 5.77 | GOOD | 9 | Low P/E compared to industry peers, making it an attractive value stock. |

| Book Value | ₹136 | GOOD | 7 | Trading near its book value (P/B ~ 1.12), indicating fair valuation. |

| Dividend Yield | 2.32% | GOOD | 6 | Decent dividend yield offering steady income, but not very high. |

| ROCE | 13.8% | GOOD | 7 | Shows efficient use of capital, though slightly below industry-leading levels. |

| ROE | 20.6% | GOOD | 9 | Strong profitability, indicating high returns for shareholders. |

| Face Value | ₹2.00 | NEUTRAL | 5 | Standard face value, doesn’t heavily impact investment decision. |

| Change in Promoter Holding | +0.25% (over 3 years) | NEUTRAL | 5 | Small increase in promoter holding, not a significant change. |

| Promoter Holding | 35.2% | GOOD | 7 | Fair promoter holding, generally a positive sign for investor confidence. |

| Pledged Percentage | 0.00% | GOOD | 9 | No pledged shares, indicating strong financial health and no liquidity concerns from promoters. |

A Brief History of Manappuram’s Growth

Manappuram Finance has had its ups and downs over the years. The company saw a period of rapid growth between FY08 and FY12, driven by the rising price of gold. During this period, its branch network expanded by over six times, and its AUM grew by more than 90% CAGR. However, regulatory changes in 2012 affected its gold loan business, as the RBI reduced the loan-to-value ratio for NBFCs.

Since then, the company has focused on diversifying its portfolio to include other lending services. Its acquisition of Asirvad in 2015 was a strategic move to enter the microfinance market, which has since become a major contributor to its overall AUM.

Impact of Asirvad Microfinance

Asirvad Microfinance, a key subsidiary of Manappuram, plays a crucial role in its growth strategy. As of Q3 FY23, Asirvad’s AUM stands at ₹8,654 crore, approximately 27% of the company’s total estimated AUM of ₹32,093 crore. The RBI’s recent regulatory restrictions on Asirvad are likely to have a short-term impact on the company’s ability to disburse new loans, thereby dampening earnings in the coming quarters. However, if the issues are resolved, it could provide an upside to the stock as the market reacts positively to the lifting of restrictions.

Technical View: Opportunity Amidst the Fall?

From a technical standpoint, Manappuram Finance’s stock price has dropped by over 33% from its all-time high, reached in July 2024. The current price of ₹153 presents an interesting opportunity for investors who believe in the company’s long-term growth potential. The stock is trading close to its 52-week low, making it an attractive value buy if regulatory risks are resolved favorably.

Fundamental View: Is Manappuram Undervalued?

Looking at the fundamentals, Manappuram appears undervalued based on its current P/E ratio of 5.77 and the fact that it is trading near its book value. The company boasts a strong return on equity (ROE) of 20.6%, zero pledged shares, and a healthy capital adequacy ratio of 31%. These indicators suggest that despite short-term regulatory hurdles, the company’s long-term fundamentals remain strong.

Should You Buy Manappuram Finance Stock Now?

While the drop in share price may seem alarming, it’s important to weigh both the risks and the potential rewards. Here’s a quick summary:

Positives

- Strong fundamentals with low P/E, high ROE, and a diversified lending portfolio.

- Zero pledged shares and decent dividend yield.

- The regulatory issue with Asirvad could be temporary, and if resolved, it may lead to a rebound in share price.

Risks

- Uncertainty surrounding the resolution of Asirvad’s regulatory challenges.

- Potential short-term earnings impact due to halted loan disbursements.

- Market sentiment may remain negative until clarity emerges on regulatory compliance.

Disclaimer: We are not SEBI-registered advisors. The information provided is for educational purposes only, and readers should take care when using it for any investment decisions.