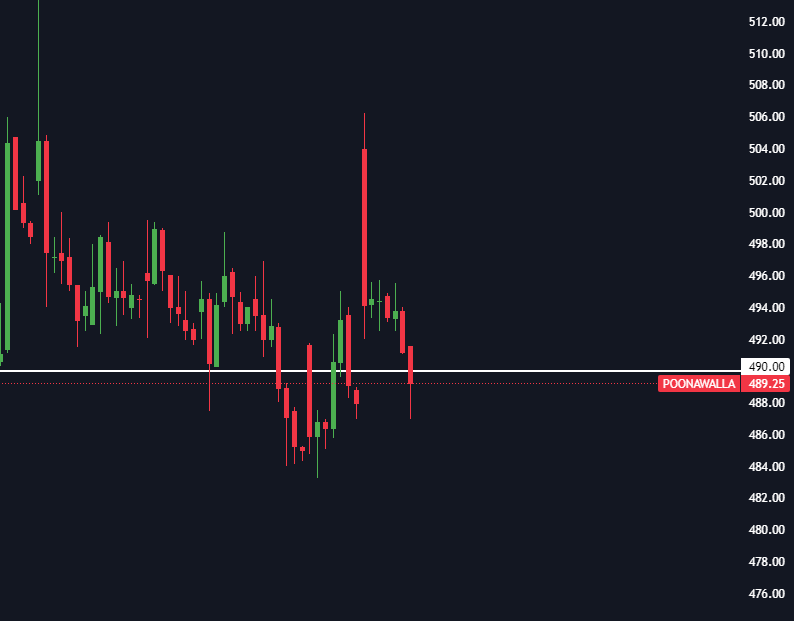

Poonawalla Fincorp Ltd. (POONAWALLA) could be on the verge of a major breakout, presenting a compelling opportunity for investors with a long-term perspective. Here’s a breakdown of the analysis:

- Current Price: ₹ 490 (as of April 30th, 2024 closing)

- Buy Recommendation: Above ₹ 491

- Target Prices:

- First Target: ₹ 520

- Second Target: ₹ 632

- Third Target: ₹ 815

- Stop-Loss: ₹ 472

Reasons for the Bullish Stance:

- The stock has been consolidating near ₹ 490, potentially indicating accumulation by investors.

- A decisive break above ₹ 491 could signal the start of a strong uptrend.

- The target prices are ambitious, reflecting the potential for significant growth based on technical analysis and future expectations.

Managing Risk:

- A stop-loss is crucial at ₹ 472 to limit potential losses if the price falls below support.

- It’s important to acknowledge that technical analysis has limitations, and market sentiment can shift rapidly.

Further Considerations:

- Conduct your own in-depth research before making any investment decisions.

- Evaluate factors like the company’s financial health, recent earnings reports, future growth prospects, and the overall lending environment before entering a trade.

- This analysis is for informational purposes only and should not be considered financial advice.

Disclaimer: The blog post reiterates that this analysis is for educational purposes only and shouldn’t be considered trading advice. Investors should always conduct their own research before making investment decisions.

Important Note: The target price of ₹ 815 is significantly higher than the other targets. This suggests a longer-term bullish outlook, and investors should be prepared to hold the stock for a potentially extended period to reach this target.