CSB Bank (CSBBANK), one of India’s oldest private sector banks, has been making waves in the financial sector. With a strong focus on retail, SME, and NRI customers, the bank has delivered impressive growth in recent years. This analysis dives into CSBBANK’s financials, strengths, and potential future performance to help investors make informed decisions (adhering to SEBI regulations).

Current Performance and Valuation

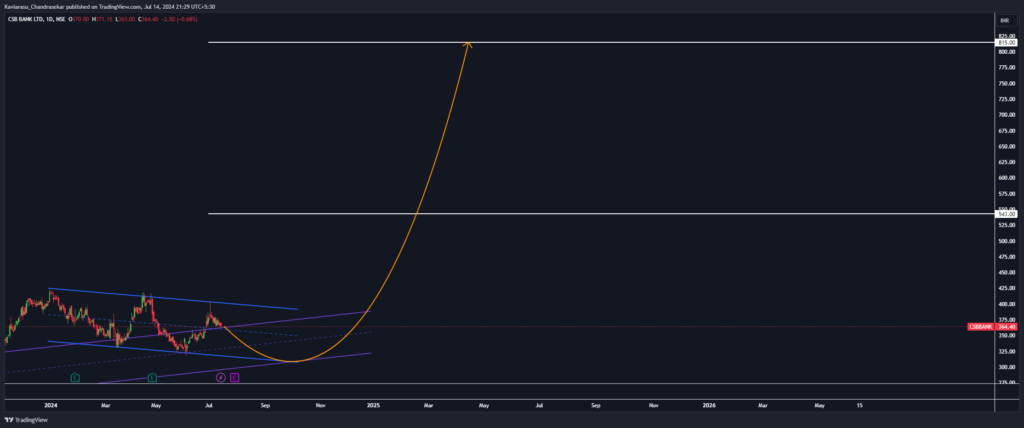

- CSBBANK is currently trading around ₹364 (as of July 12th, 2024).

- The bank boasts a healthy price-to-earnings ratio (P/E) of 11.2, significantly lower than the Indian banking sector average.

- This suggests CSBBANK might be undervalued by the market.

STRENGTH

- Strong Brand in South India: With over 94 years of history, CSBBANK enjoys a well-recognized and trusted brand image, particularly in South India (Kerala, Tamil Nadu, Karnataka). This loyal customer base fosters stability and growth.

- Focus on CASA Deposits: CSBBANK prioritizes Current and Savings Account (CASA) deposits, providing a steady source of low-cost funding to fuel their lending activities. This improves profitability and reduces reliance on volatile market sources.

- Profitable Growth Trajectory: The bank boasts an impressive Compound Annual Growth Rate (CAGR) exceeding 37% in the past five years. This trend indicates strong financial management and the ability to generate consistent returns.

- Focus on Retail and SME: CSBBANK caters to the retail and SME segments, offering customized products and services. This focus on underbanked sections presents significant growth potential.

WEAKNESS

- Limited Geographic Reach: Compared to national players, CSBBANK’s presence is primarily in South India. This limits potential customer base and diversification opportunities.

- Low Interest Coverage Ratio: The bank’s interest coverage ratio is lower than ideal. This indicates some vulnerability to rising interest rates, as it may impact their ability to service existing debt.

- No Dividend Yield: Unlike some peers, CSBBANK currently doesn’t offer a dividend yield. This might deter income-seeking investors who prioritize regular payouts.

- High Contingent Liabilities: CSBBANK has a relatively high level of contingent liabilities, which could potentially materialize into future financial obligations.

OPPORTUNITIES

- Credit Expansion: CSBBANK has the potential to expand its credit portfolio, particularly in the underbanked retail and SME segments. This growth engine can fuel future profitability.

- Digital Transformation: Embracing digital banking solutions can enhance customer experience, attract new clientele, and improve operational efficiency.

- Geographic Expansion: Strategically expanding into new geographic regions can diversify the customer base and reduce dependence on the South Indian market.

THREATS

- Competition: The Indian banking sector is fiercely competitive, with established players and new fintech entrants vying for market share. Maintaining a competitive edge is crucial.

- Regulatory Changes: Regulatory changes from the Reserve Bank of India (RBI) can impact the bank’s profitability and operational practices. Staying compliant and adapting quickly is essential.

- Macroeconomic Environment: Broader economic factors like inflation and interest rate hikes can affect loan demand and overall business performance.

- Rising NPAs: Non-Performing Assets (NPAs) pose a risk to the bank’s financial health. Effective risk management is vital.

Potential Upsides

- Given the bank’s growth trajectory and potential for credit expansion, the stock price could reach analysts’ optimistic targets of ₹543 or even ₹815 in the long term.

Important Considerations

- CSBBANK currently offers no dividend yield, which might be a concern for income-seeking investors.

- The bank’s low interest coverage ratio indicates some vulnerability to rising interest rates.

- Recent promoter holding decrease and high contingent liabilities are factors to keep in mind.

Investor Takeaway

CSBBANK presents a compelling case for investors seeking growth in the Indian banking sector. The bank’s strong financials, focus on profitable segments, and potential for credit growth are positive indicators. However, investors should carefully consider the potential risks, including the lack of dividends and the impact of rising interest rates, before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Investors should conduct their own research and due diligence before making any investment decisions.