Ganesh Benzoplast Ltd. is a leading manufacturer and supplier of specialty chemicals, food preservatives, and industrial lubricants in India and internationally. Incorporated in 1986, the company boasts a long history of success in the Indian chemical industry.

Here’s a quick snapshot of Ganesh Benzoplast:

- Industry: Chemicals

- Sector: Specialty Chemicals

- Products: Sodium Benzoate, Benzoic Acid, Methyl Benzoate, Benzoplast, and other additives

- Services: Liquid storage tanks for storing liquid chemicals, oil products, petroleum products, petrochemicals, biofuels, and vegetable oils.

- Headquarters: Mumbai, Maharashtra, India

- Website: https://www.ganeshbenzoplast.com/

Ganesh Benzoplast operates through two main segments:

Liquid Storage Terminal (LST): This division provides storage tanks for various liquid products and offers storage and handling solutions. They have terminals strategically located at JNPT (Navi Mumbai), Cochin, and Goa.

Chemical: This division manufactures and sells a variety of specialty chemicals, including sodium benzoate, benzoic acid, and other additives used in various industries. Notably, Ganesh Benzoplast enjoys a virtual monopoly on pure Benzoic Acid & its derivatives in India, offering a strong market position.

- Stock Symbol: GANESHBE

- Stock Exchange: NSE

- Current Market Cap: ₹10.88 Billion

Recent Performance:

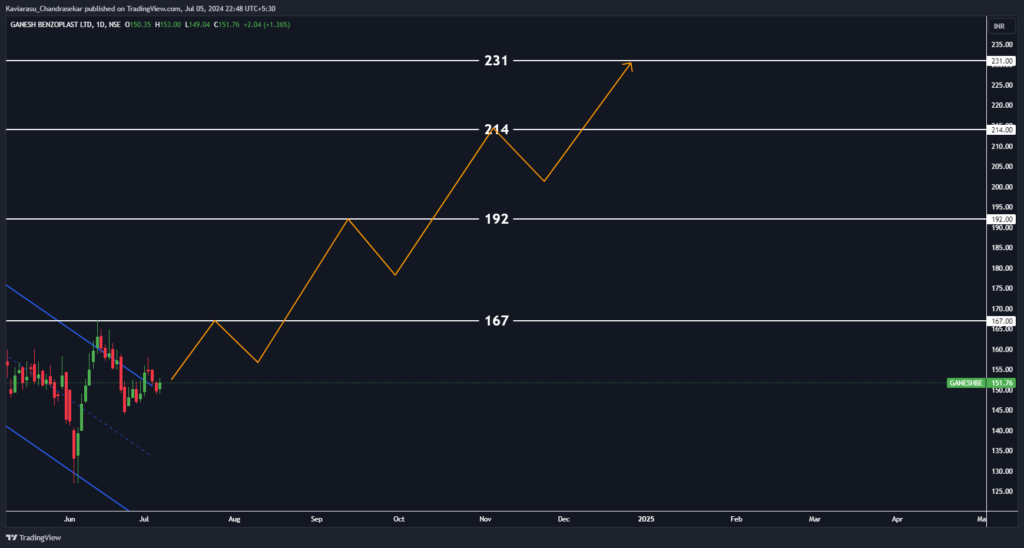

- Ganesh Benzoplast’s share price is ₹151.20 (as of July 5, 2024).

- The stock is currently trading in a channel range.

- The company witnessed a strong QoQ revenue growth of 42.3% in the last quarter, the highest in the last 3 years.

- Over the past 3 years, the stock has delivered a return of 96.59%, outperforming the Nifty Smallcap 100 which gave a return of 80.38%.

STRENGTH

- Strong Return on Capital Employed (ROCE) of 20.34% maintained over the past 3 years

- Virtually debt-free company with a healthy interest coverage ratio.

- Efficient cash conversion cycle and good cash flow management.

- Positive net income for the last twelve months.

- Positive three-year average ROIC (Return on Invested Capital).

WEAKNESS

- Lacks analyst price targets, making future projections difficult.

- No recent dividend payouts

OPPORTUNITIES

- Ganesh Benzoplast enjoys a virtual monopoly on pure Benzoic Acid & its derivatives in India, offering a strong market position.

- The company’s recent strong revenue growth suggests potential for continued market share gains.

THREATS

- Competition emerging in the Benzoic Acid market could erode Ganesh Benzoplast’s market share.

- Fluctuations in raw material prices could impact profitability.

Technicals:

- The stock is currently trading in a channel range. A break above ₹160 could signal a potential long position with target prices of ₹167, ₹192, ₹214, and ₹231.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.