Jindal Steel & Power Ltd is a significant player in the Indian steel and energy sector. With a market capitalization of ₹1,02,606 crore, the company has shown steady growth over the years, making it a stock worth monitoring.

Key Financial Indicators

Let’s take a closer look at the core financial metrics:

- Market Cap: ₹1,02,606 Cr.

- Current Price: ₹1,006

- 52-Week High/Low: ₹1,097 / ₹582

- Stock P/E: 18.4 – Indicates that the stock is priced at 18.4 times its earnings.

- Book Value: ₹434 – This represents the company’s net asset value per share.

- Dividend Yield: 0.20% – A modest return for income-seeking investors.

- ROCE (Return on Capital Employed): 13.2% – Measures how efficiently the company is generating profit from its capital.

- ROE (Return on Equity): 14.1% – Indicates the profitability relative to shareholders’ equity.

- Promoter Holding: 61.2% – Strong promoter interest, with a slight increase of 0.74% in the last 3 years.

- Pledged Percentage: 13% – A part of promoter’s holding is pledged.

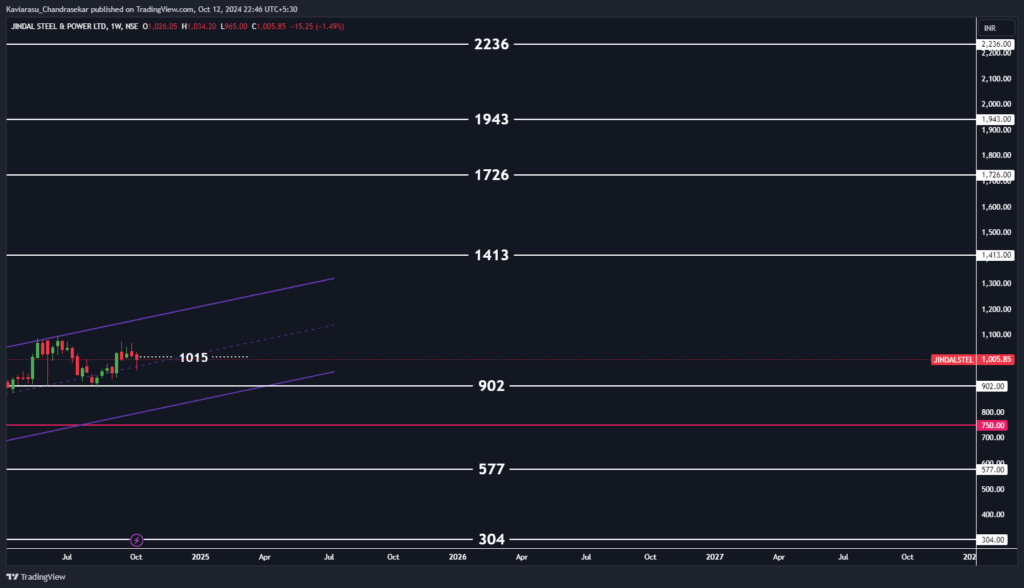

Technical Analysis Overview

From a technical standpoint, Jindal Steel & Power Ltd is showing promising levels for those tracking its price movements.

- Current Level: Rs. 1,006

- Potential Upside: Watch for movements above the ₹1,015 range. This level could indicate further momentum.On the downside, the stock may revisit:

- ₹902

- ₹577

- ₹304

These levels offer potential opportunities for strategic entry points based on individual preferences.

Potential Targets for Swing Trading

If the stock breaks key levels, potential targets to watch include:

- First Target: ₹1,413

- Second Target: ₹1,726

- Third Target: ₹1,943

- Extended Target: ₹2,236++

These target levels make Jindal Steel & Power Ltd an interesting candidate for swing trading.

Final Thoughts

While Jindal Steel & Power Ltd presents a solid case with favorable financials and technical signals, investors should conduct their own research before making any decisions. Given the company’s strong promoter backing and reasonable P/E ratio, it could appeal to both long-term investors and swing traders.

Disclaimer: We are not SEBI-registered advisors. The information provided is for educational purposes only, and readers should take care when using it for any investment decisions.