Sona BLW Precision Forgings Ltd. is a leading manufacturer of automotive components in India. They specialize in precision forging, machining, and assembly of critical drivetrain components for passenger vehicles, two-wheelers, and commercial vehicles. The company is well-positioned to benefit from the growing electric vehicle (EV) market.

Current Stock Price

₹665.30 (as of July 4, 2024, 3:30 PM IST)

Recent Performance

- Q4FY24 Results:

- Revenue: ₹885 crore, YoY growth of 19%

- BEV Revenue Share: 32%, YoY growth of 34%

- EBITDA: ₹248 crore, margin of 28.0%, YoY growth of 23%

- PAT: ₹149 crore, net profit margin of 16.7%, YoY growth of 24%

- Net Order Book: ₹22,600 crore as of March 31, 2024, with EV programs contributing 79%

STRENGTH

- Strong Revenue and Profit Growth: The company has shown good revenue growth of 27.37% and profit growth of 30.89% for the past 3 years [ticker.finology.in].

- Healthy Profitability: Maintains healthy ROCE (Return on Capital Employed) of 23.50% over the past 3 years and effective average operating margins of 27.11% in the last 5 years.

- Strong Financial Position: Virtually debt-free with a healthy interest coverage ratio of 25.78 and efficient cash conversion cycle of 36.05 days.

- Good Cash Flow Management: Maintains a strong CFO (Cash Flow from Operations) to PAT ratio of 1.19.

WEAKNESS

- High Valuation: The company currently trades at a high PE ratio of 81.47 and EV/EBITDA of 45.45, which might be a concern for some investors

OPPORTUNITIES

- Growing Electric Vehicle Market: The company is well-positioned to benefit from the increasing demand for EV components, with a significant portion of their revenue and order book already coming from EVs.

- Rising Demand for Forged Components: Forged components offer superior strength and weight reduction compared to traditional cast components, which aligns well with the industry’s focus on light weighting vehicles.

THREATS

- Competition: The automotive component industry is highly competitive, and Sona BLW faces competition from domestic and international players.

- Fluctuations in Raw Material Prices: The company’s profitability can be impacted by fluctuations in the prices of steel and other raw materials.

- Slowdown in the Auto Industry: An overall slowdown in the auto industry could negatively impact Sona BLW’s sales.

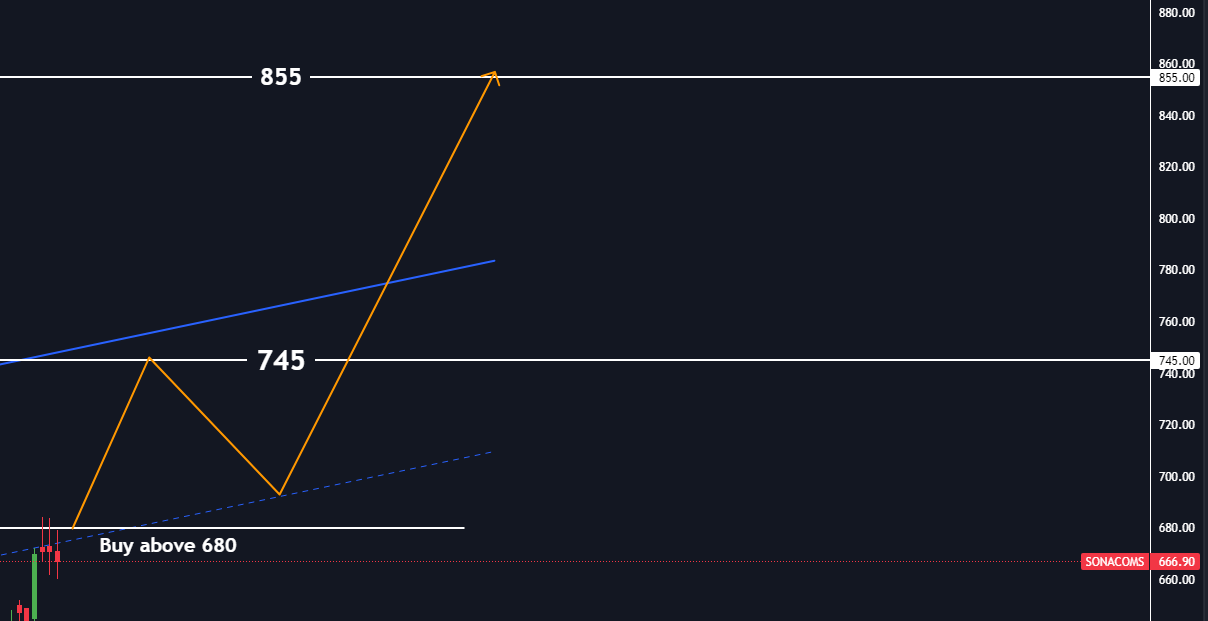

Technical

- The stock is currently trading in a channel range. A breakout above ₹680 could signal a long opportunity with potential targets of ₹745 and ₹855.

Disclaimer: The information provided in this blog post is for informational purposes only and should not be considered as financial advice. While the content is based on publicly available data and analysis, investing involves inherent risks. Please conduct your own thorough research and consult with a financial advisor before making any investment decisions.