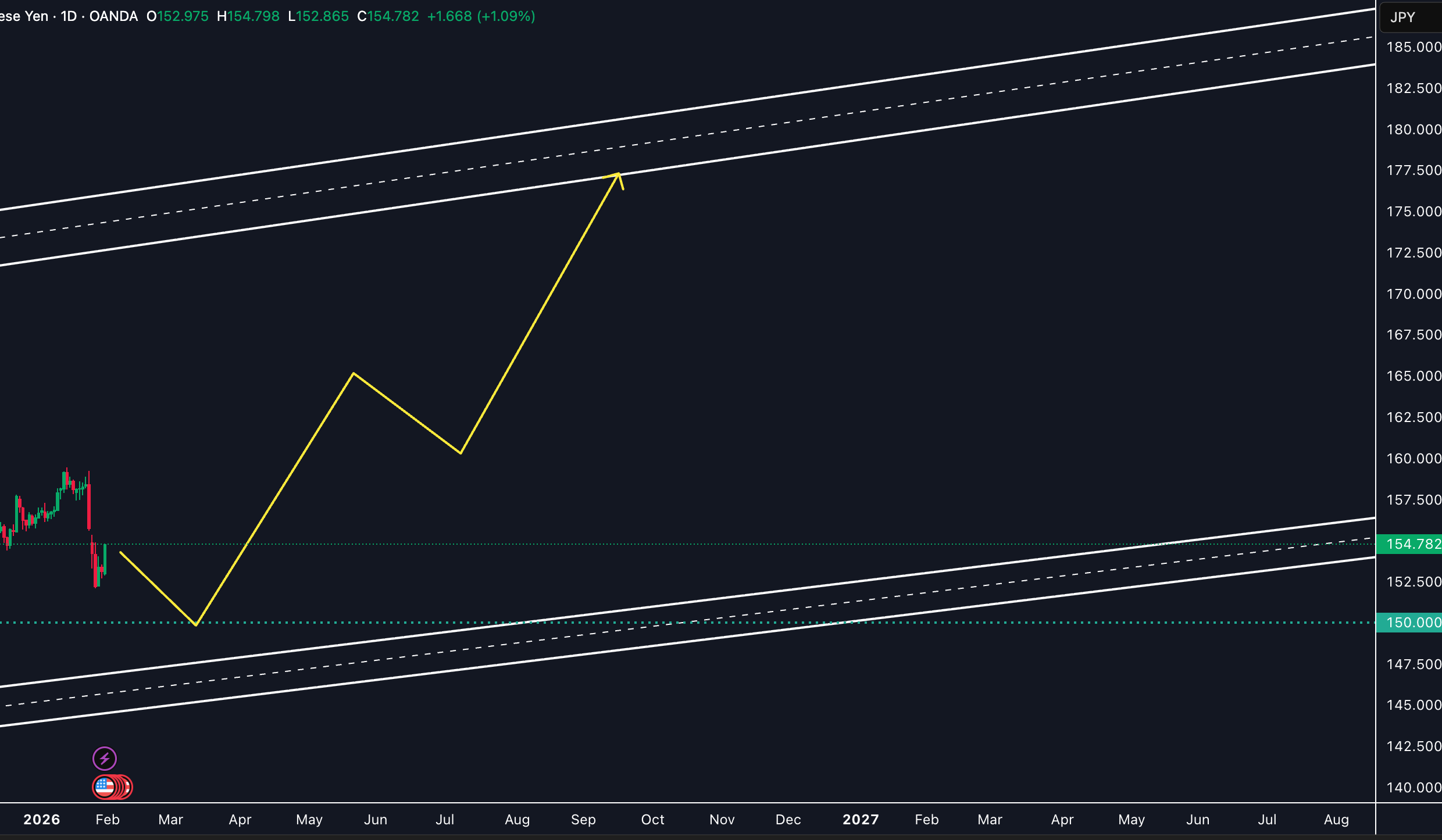

After a tumultuous January that saw the Japanese Yen move from the brink of collapse at 159.00 back to the safe-haven embrace of the 152.00–153.00 zone, traders enter February with one question: Has the floor finally been found?

As we look toward the week of February 2, the USD/JPY pair sits at a critical crossroads, caught between a hawkish U.S. Federal Reserve and a Bank of Japan (BoJ) that is increasingly losing its patience.

The Macro Narrative: A Tale of Two Policies

The Federal Reserve kicked off the year by holding rates steady at 3.50%–3.75%, signaling that they are in no rush to ease policy while inflation remains “sticky.” On the other side of the Pacific, the Bank of Japan is holding its 0.75%rate, creating a massive interest rate differential that continues to favor the “Carry Trade” (buying USD/JPY to earn interest).

However, the “BoJ Intervention” boogeyman has returned. Following reports of NY Fed “rate checks” last week, the market is terrified of a coordinated strike to strengthen the Yen.

Technical Battlegrounds for the Week Ahead

- The 150.00 “Iron Floor”: This remains the ultimate psychological and technical target for value buyers. The 200-day Moving Average and historical demand reside here.

- The 156.50 Ceiling: Any recovery attempt will face heavy selling pressure at 156.50, where traders who were “trapped” in January’s long positions will likely look to exit.

Key Events to Watch

- US Non-Farm Payrolls (NFP): The “King of Data” arrives this Friday. A strong jobs report could propel USD/JPY back toward 157.00, while a miss might finally provide the momentum needed to test the 150.00handle.

- Japan’s Snap Election (Feb 8 Countdown): Political uncertainty usually weakens a currency. Expect the Yen to remain “twitchy” as we approach next Sunday’s vote.

The Play: Look for stability. If the pair holds above 153.00 early in the week, we may see a slow crawl back to 155.50. If 153.00 breaks, clear the decks and prepare for the 150.00 psychological test.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. We are not SEBI registered advisors.